September 22, 2008

Does CNBC Cause Market Volatility?

Books will be written about this financial crisis, but no one has brought up one important factor, and it is summarized by this single soundbite, from Friday September 17, 2008, at exactly 4:00pm EST:

"...and there's the closing bell, I'm Bob Pisani, and I just have to say in my 18 years at CNBC, I have never been more proud of my news team than I am now...."

They are good reporters, dedicated and hardworking, I'll give him that, but was the reporting itself better than it was on other days? What else would there be to be proud of?

The problem, as everyone on CNBC reminds, is one of liquidity, not solvency. In other words, the financial institutions have money, but are overleveraged. As long as no one calls in their loans, as long as there isn't a run on the banks-- as long as these institutions are given time, then they can rise the capital, or deleverage. They just need time.

Bear Stearns didn't have time. FNM, FRE-- no time. Maybe in a year housing prices rebound? No one can wait that long. Etc, etc.

And so one must wonder what part CNBC and the media in general played in this very real catastrophe. Maybe if the media hadn't been reporting about-- sensationalizing?-- financial Armageddon so zealously, perhaps there wouldn't have been a run on money market funds, calls to congressmen about the safety of their pensions, etc-- and maybe the institutions could have had-- what, another month? Two weeks, even? AIG held out until the end, defiant, until the government kicked them in the head to roll over. What could they have done in another two weeks?

Who knows?

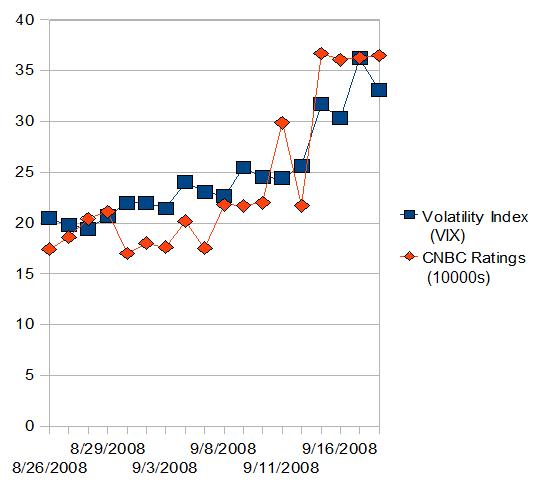

It's hard to say what relationship there is between, say, CNBC's ratings and measures of market volatility:

Oh wait, never mind, it isn't that hard after all.

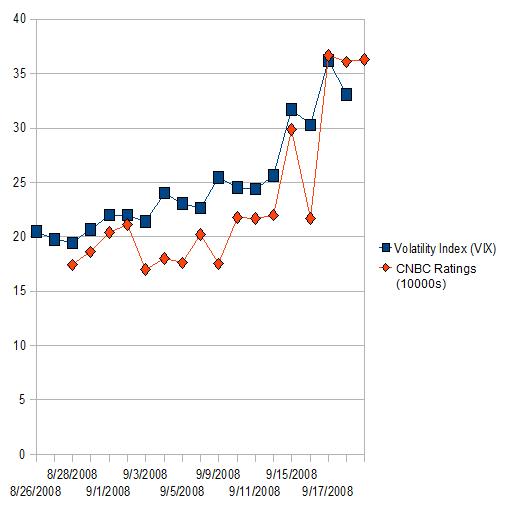

In case you can't see it, here's the same graph with the CNBC ratings data shifted two days:

The greatest monetary shift in this country's history is real. But, as with politics, science, law, medicine and the arts, we don't interpret reality, we interpret other people's interpretations of reality.

Which is why I say: America hates the red pill.

7 Comments