November 26, 2008

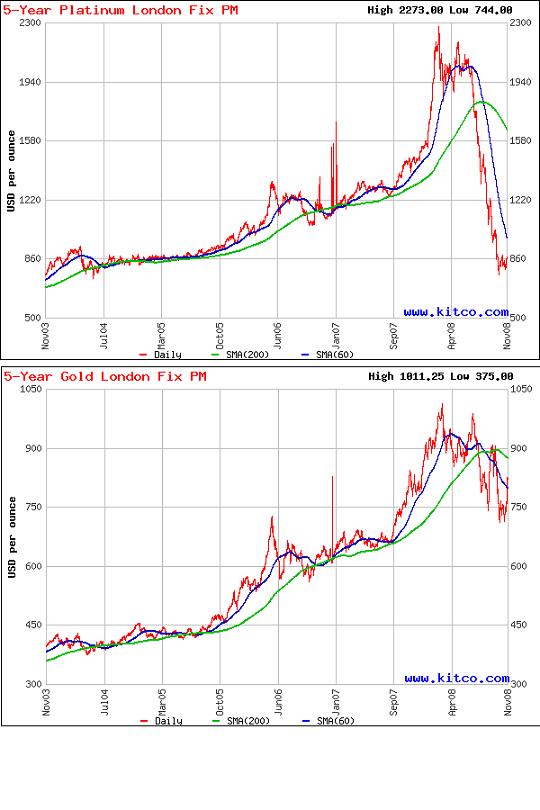

Has Anyone Noticed That Price Of Gold And Platinum Is The Same?

For the first time in history, the price of gold and platinum are almost exactly the same. Think about that. This has never happened before, ever.

Put another way: you have some gold, and you can trade it in for the same weight in platinum.

I don't know if that's bearish for gold (it goes to $500) or superbullish for platinum (back to $1580) but it is clearly a situation which cannot last. Plan accordingly.

Put another way: you have some gold, and you can trade it in for the same weight in platinum.

I don't know if that's bearish for gold (it goes to $500) or superbullish for platinum (back to $1580) but it is clearly a situation which cannot last. Plan accordingly.

Platinum has almost always been at least double the price of gold, or at least $400 higher. Fewer catalytic converters? Russian releasing their reserves?

9 Comments