September 22, 2010

The Terrible, Awful Truth About The Tax Cuts

won't help

I. The $250,000 Question: Will Atlas Shrug? No, He's A Punk

So they're going to uncut taxes for the rich, as defined as over $250k/yr. Everyone seems to know the answer: is $250k a year rich, and why do they say they can't afford it?

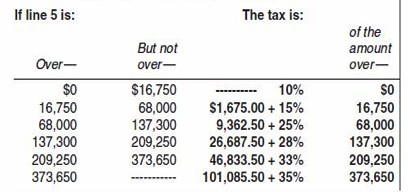

Which really isn't what the arguing is about. That 4% tax increase is not on 250k but on any money above 250k, which means if you make 300k you're taxed an extra 4% on the 50k. Oh well, no ki-ran burgers for a week.

The real controversy, brought to you in HD, is about "fairness," which is defined not by the ends but by the means-- that's the only way to excite the amygdala enough to get you to tune in. Ask John Galt why Americans will soberly and willingly part with 80% of their income if it makes sense to do so/they want an Acura, but try and take 4% and they'll gas an elementary school.

II. "I'm telling!"

Who decides fair? In the U.S., fair could mean democracy, so let's ask them: what do the majority of Americans want? They want 2% of you to pay more taxes. If you don't like it, you can move to the Caymans. Your business is already there, isn't it?

If this logic appeals to you, then you're not going to like the next part: this isn't a democracy, it's a businessocracy, which means the government isn't going to obey the will of the majority of the voters, but the majority of corporations. So: according to the gerrymandered voting of the S&P 500, what will taxes do?

Answer: they're still going up, because the corporations don't care about AGI, they care about corporate taxes, which are never going to go up, not if you want to keep your job. "Labor costs" is the answer to every political and economic question. All that other stuff about rich and poor are for ratings, to draw you into the electric coffeehouses and get you agitated, and for politicians who need a mulligan. In other words, it's for suckers. You're not a sucker, are you?

I understand that tax policies have serious effects on people, but the setting of tax policy has much less to do with revenue generation than giving voters a fairness boner. We spent $3.6T this year; these tax uncuts are going to generate $700B over ten years, assuming they don't simply get recut in four years anyway. So why are we bothering?

"The rich have to pay their fair share!" Let's look at the Adjusted Gross Income of the United States Government.

Corporate Tax: 12.9%

Individual Income Tax: 52%

Employment Tax: 32.2%

Estate Taxes: 1.1%

Excise Taxes: 1.9%

Take a moment and redistribute your fairness points.

III. Why a Tax on The Rich?

Why $250k? That number didn't come from the Bible, it is the income level that accounts for about 50% of the income tax revenue. Fortunately, it is also only about 2% of the population, so you only have to piss off 750,000 people. That's democracy. Eat it.

Why not just crush their spirits and raise their taxes 20% instead of just 4%? Because they're not stupid, they'll alter the way they get paid. W-2s become 1099s, 1099s become non-cash compensation (car, homes, etc.) And more business deductions, I for one will try to deduct rum expenses under fuel costs. The proof is in the writing.

"We won't employ contractors and nannies!" Yes you will, come on, you don't know how to entertain a 2 year old any more than you know how to put up dry wall. None of that matters anyway, not hiring another contractor pales in comparison to what Pfizer will do if Obama raises corporate taxes, or, more rigorously accurately, what Pfizer will threaten to do if Obama threatens to raise corporate taxes. Those 39 words and 4 commas may seem confusing to you, but-- and this is the point-- they are not confusing to Obama. Hence, a tax increase on the rich.

IV. The Terrible, Ugly Truth

50% of the budget goes to Social Security, Medic*, and unemployment/welfare. Add another 20% for defense, and that's pretty much the blueberry piechart. I have no ability to assign relative moralopolitical value to these things, but I can state with certainty that none of them pay for themselves. Unless DoD spending yields practical nuclear fusion or robot lawn mowers, most of that money is just a form of white collar, defense industry (and everyone they employ) welfare. And the real problem isn't today, it's over time. The baby boomers have only started to retire, and they won't be cheap.

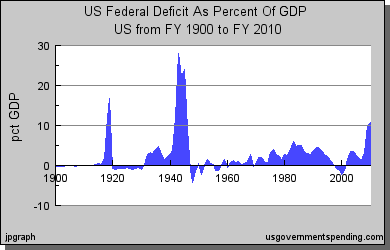

There is a terrible, terrible, ugly truth underlying all of this, and that is that taxes don't matter to a government that can print money. The government collected $2.4T and spent $3.6T. They'll take what they get, of course, but if they had collected $2T or $3T you/they would not have noticed. The country isn't a household, it is a bank, and as long as the rest of the world believes "we're good for it," then we are. When it decides otherwise, look out. The US will go Lehman Brothers faster than you can say Bear Stearns.

V. Were We Wrong?

Some fundamental assumptions have turned out wrong. For example, we always talk about income. But we never talk about wealth. In France, they tax wealth-- literally a tax on assets. They earned 4.5 billion euros from that and France's population is 1/4th as large and not nearly as wealthy or funny. Furthermore, every country in Europe has a VAT tax, which is quite high, sometimes over 20% on consumer products. But a VAT is completely unAmerican because the US's entire existence is predicated on consumption. France has lots of other taxes that are probably socialist, but then again, isn't a $700B TARP fund socialist? It's as annoying.

More to the point, if the TARP fund was necessary to prevent large scale social disruption among all workers (not just the finance industry), and the 2008 crisis was simply the result of people behaving unethically/injudiciously but otherwise legally, then (a) some crisis was inevitable because you can't legislate ethics for every possible scenario, and therefore (b) US-style capitalism is only possible in the buffer of emergency sharp turns into socialism. To phrase it in terms of books everyone has heard of but no one has actually read, Disaster Capitalism relies on The Black Swan event which is ultimately a consequence of the institutional structure of capitalism (not a natural disaster) to periodically deploy the Shock Doctrine to prevent the institution from actually changing. Long Tail that one, wildman.

VI. So Socialism Is The Answer?

To what? You don't even know what the question is.

The tax code many be complicated, all the talk on CNBC may seem technical, but our problem here is concrete, all you need are the numbers: we took in $2.4T and spent $3.6T. Anyone who attempts to discuss tax policy without including those two numbers has a whole different agenda which probably includes giving you AIDS. Run.

$2.4T in, $3.6T out. That's everything. And don't tell me that some of our expenses are one-offs, like Katrinas or Iraqs, it is no different than blaming your budget deficit on your vacation to Disneyland. Next year you'll want to go to Disneyworld or Paris or carpetbomb Iran or tow California back out of the ocean, there's always another unexpected expense. And truth up, even if there were no unexpected expenses you wouldn't save the money, you'd spend it on drugs and shoes.

So what can be done?

Well, here are some ideas that I got from science fiction movies, along with tube cars and blinky lights on our hands telling us it's time to go:

You could raise corporate taxes by 1-3%. I understand the Pfizer result here (firing people) but the reality is they fired people anyway, so what was the point? That they won't fire more people? LABOR COSTS. The move towards globalization is happening independent of tax policy, the limiting factor isn't Pfizer's willingness to do it but Romania's willingness to go along with it. I don't need to defend my capitalism credentials, but if the ultimate end of capitalism is to convince you you need high fructose corn syrup, the system needs some adjustment, and that adjustment is about 3%.

Or a VAT. Or a tax on wealth. Warren Buffet observed that he pays little income tax because he has little income. A 1% tax on wealth over some number could bring in a lot. Buffett has $40B, you could get $400M out of him alone, and he seems up for it. The combined net worth of the Fortune 400 is $1.2T; 1% of that is $12B a year, and here you'd only have to piss of 400 people. But, as I said, that's democracy.

Aren't these ideas anti-capitalist? It doesn't matter, they'll never happen. $2.4T in, $3.6T out. That's all that matters.

VII. The Other Ugly Truth

If you doubled income tax receipts on the rich, you still wouldn't cover the deficit.

VIII. Is $250,000 rich?

Fun fact: how much money does it take to raise kids? To quote the great Ron Bennington: "All of it." You'll spend 10x more to send them to a 1.5x better school. Who could fault you? The alternative is school loans, which end up being a mortgage on a house you can never sell. Those time burglars are also gonna need iPads.

"Is $250,000 rich?" is a question that wants to be written, "the country needs the money, where can we get the money from?"

Which makes this next part so easy. The deficit is 10% of the GDP, a generational high. Either we cut spending or we raise our GDP, e.g. by inventing fusion engines or robot lawnmowers.

So if we're not willing to cut spending, we have to turn to business. It's that simple, because the country can't generate the revenue any other way. We rely on corporations for everything, jobs, insurance, lifestyle, products, mate selection. Say whatever you want at the CNN podium, bash the rich, shame the poor, it makes no difference. You may as well double down on the market and ride out the bump, because if it doesn't go up you'll have bigger problems than your portfolio. Pretending to reduce greenhouse gases or paying for MRIs or supporting welfare cheats or killing Muslims all costs money, if the government wants to keep doing these things and more the market has to go up. It is inevitable.

$2.4T in and $3.6T out. That's all. The reason why "is $250,000 rich?" is so hard to answer and pointless to ask is the same reason the government is in trouble. If you spend more than you take in, it doesn't matter how much money you make. You're not rich, you're doomed.

---

(pastabagel gets another writing credit)

---

http://twitter.com/thelastpsych

55 Comments