May 21, 2010

The Other Technical Analysis

the American male may be dead, but the consumer is not

the American male may be dead, but the consumer is not

I. The Machines Are In Charge Until At Least 2012

If you accept the proposition that the government is doing whatever it can to prevent further deflation, then you can also say that the fundamentals of the market are at least temporarily being overruled.

If fundamentals are less important, then technicals are more important. The Machines are running the short term show.

Whatever caused the "flash crash" may or may not happen again, but it was inevitable that we would return to that low. Similarly, it was inevitable that the machines will read the red 200dma as a support (next day), the blue 50dma (and arrow) as a resistance, and, currently, that they would see the low back in February (yellow) as a support. It must bounce off that point-- not because the fundamentals warrant it, but because the machines have that locked in as a key point.

It doesn't mean it can't bounce and then go much lower again-- but bounce it must.

II. My Precious

A while ago I noted the unusual finding that gold and platinum were selling at the same price. That's not a world I want to live in. So platinum has raced ahead, now at $1500/oz while gold is at $1100.

The ratio is now fixing itself:

We're still in a deflationary world. Maybe someday we get inflation. But in both cases, gold goes higher (gold goes down during times of slowing inflation.) I thus conclude that in order for the ratio to be acceptable in a universe that does not permit more than one season of Miami Medical, platinum must go even higher. I am aware that the supply of platinum has increased and more is coming, but again, fundamentals matter less in the short term. Plan according to your beliefs.

III.

I'll make three longer term, fundamental points.

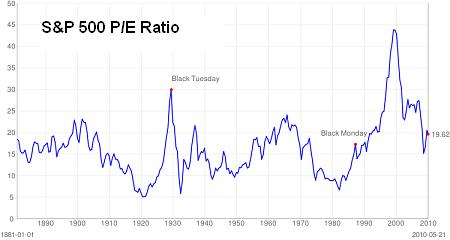

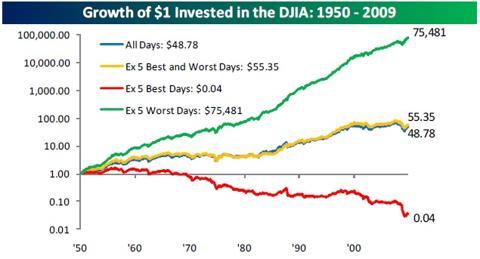

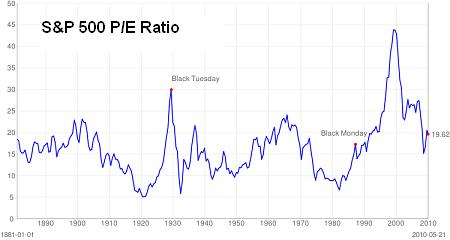

1. Stocks

What's a fair P/E for another year's worth of economic nonsense? Assume a PE of 13-15, and S&P earnings of $70, you get 950 level for the S&P. That can be considered a fair value for the S&P.

However, to the extent possible, the U.S. government wants it to be the bottom, and will do whatever is necessary to make it so.

2. Consumer Sentiment

You can measure the economic growth and consumer sentiment through a million abstruse metrics, but for me, as go Aeropostale and Apple, so goes the country.

You can measure the economic growth and consumer sentiment through a million abstruse metrics, but for me, as go Aeropostale and Apple, so goes the country.

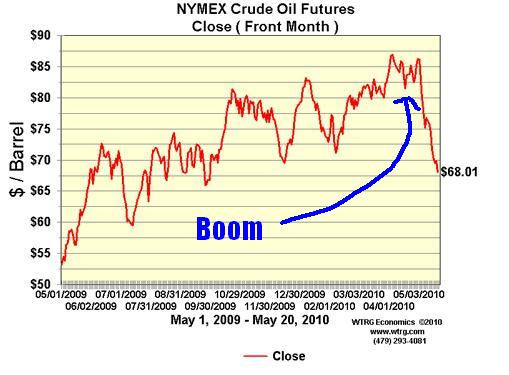

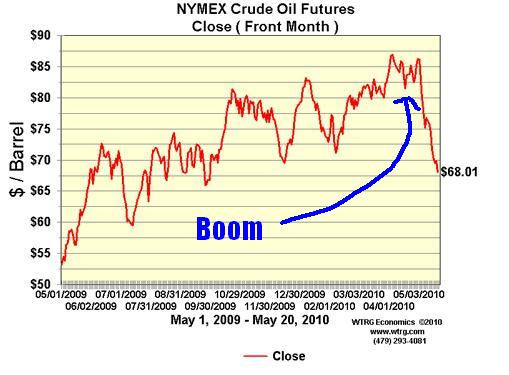

3. Oil

When the BP oil well blew up in celebration of Hitler's birthday and started leaking 50k barrels/d of precious, delicious oil all over the place, because that's what he would have wanted, you would be forgiven for thinking that it would drive oil prices spectacularly higher.

Nope.

Nope.

It's all about the value of the dollar and, more importantly, growth prospects here and abroad. In Europe, those prospects aren't good (for now.) That blip upwards on May 10 was when the EU announced a $900B bailout.

You may want to take this as a sign that the supply of oil isn't fundamentally the problem, but rather the demand.

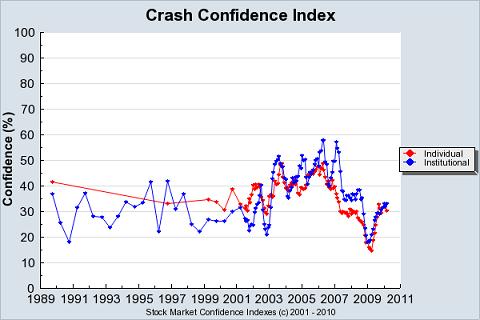

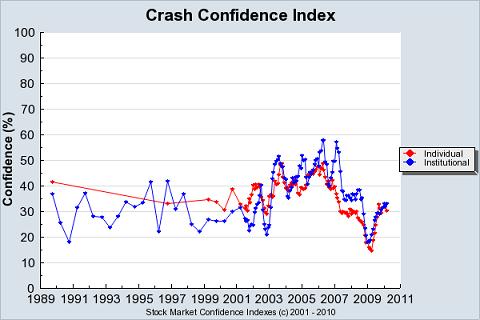

4. When Humanity Gets Together And Decides To Do Something With One Voice, Are They Always Wrong?

This Shiller Imaginarium product surveys the confidence of investors that there will NOT be a market crash in the next 6 months. Draw your own conclusions.

This Shiller Imaginarium product surveys the confidence of investors that there will NOT be a market crash in the next 6 months. Draw your own conclusions.

5. Is This The End Of The World?

(previously):

---

http://twitter.com/thelastpsych

If you accept the proposition that the government is doing whatever it can to prevent further deflation, then you can also say that the fundamentals of the market are at least temporarily being overruled.

If fundamentals are less important, then technicals are more important. The Machines are running the short term show.

Whatever caused the "flash crash" may or may not happen again, but it was inevitable that we would return to that low. Similarly, it was inevitable that the machines will read the red 200dma as a support (next day), the blue 50dma (and arrow) as a resistance, and, currently, that they would see the low back in February (yellow) as a support. It must bounce off that point-- not because the fundamentals warrant it, but because the machines have that locked in as a key point.

It doesn't mean it can't bounce and then go much lower again-- but bounce it must.

II. My Precious

A while ago I noted the unusual finding that gold and platinum were selling at the same price. That's not a world I want to live in. So platinum has raced ahead, now at $1500/oz while gold is at $1100.

The ratio is now fixing itself:

We're still in a deflationary world. Maybe someday we get inflation. But in both cases, gold goes higher (gold goes down during times of slowing inflation.) I thus conclude that in order for the ratio to be acceptable in a universe that does not permit more than one season of Miami Medical, platinum must go even higher. I am aware that the supply of platinum has increased and more is coming, but again, fundamentals matter less in the short term. Plan according to your beliefs.

III.

I'll make three longer term, fundamental points.

1. Stocks

What's a fair P/E for another year's worth of economic nonsense? Assume a PE of 13-15, and S&P earnings of $70, you get 950 level for the S&P. That can be considered a fair value for the S&P.

However, to the extent possible, the U.S. government wants it to be the bottom, and will do whatever is necessary to make it so.

2. Consumer Sentiment

You can measure the economic growth and consumer sentiment through a million abstruse metrics, but for me, as go Aeropostale and Apple, so goes the country.

You can measure the economic growth and consumer sentiment through a million abstruse metrics, but for me, as go Aeropostale and Apple, so goes the country.3. Oil

When the BP oil well blew up in celebration of Hitler's birthday and started leaking 50k barrels/d of precious, delicious oil all over the place, because that's what he would have wanted, you would be forgiven for thinking that it would drive oil prices spectacularly higher.

Nope.

Nope.It's all about the value of the dollar and, more importantly, growth prospects here and abroad. In Europe, those prospects aren't good (for now.) That blip upwards on May 10 was when the EU announced a $900B bailout.

You may want to take this as a sign that the supply of oil isn't fundamentally the problem, but rather the demand.

4. When Humanity Gets Together And Decides To Do Something With One Voice, Are They Always Wrong?

This Shiller Imaginarium product surveys the confidence of investors that there will NOT be a market crash in the next 6 months. Draw your own conclusions.

This Shiller Imaginarium product surveys the confidence of investors that there will NOT be a market crash in the next 6 months. Draw your own conclusions.5. Is This The End Of The World?

(previously):

---

http://twitter.com/thelastpsych

3 Comments